MarkNtel Advisors presents a comprehensive research report on the Asset Integrity Management Market Size, Share, Analysis, Future expected to reach CAGR of 5.67% by 2028. delving into a thorough analysis of the industry's changing dynamics, growth drivers, challenges, key trends, and lucrative opportunities. This study aims to provide stakeholders in the market with detailed insights, enabling them to make informed and strategic decisions that will yield higher revenues in the coming years. With a focus on delivering value, the report covers a wide range of aspects, ensuring a holistic understanding of the market landscape.

Unlocking Market Insights: Exploring Key Aspects in the Asset Integrity Management Market Report (2023-2028)

- It analyzes the fluctuations in revenue across different segments and geographical regions, considering the evolving trends and purchasing patterns of end-users.

- The report highlights key developments, including the introduction of new services, expansion of product portfolios, revenue generation strategies of major players, stakeholder investments, and the role of governments.

- Additionally, it offers an unbiased overview of market trends, innovations, technological advancements, and fluctuations, as observed by industry experts.

- To ensure reliable data generation and analysis, the report utilizes tools such as SWOT (Strengths, Weaknesses, Opportunities, Threats) and PESTLE (Political, Economic, Social, Technological, Legal, and Environmental) analysis.

- The competitive landscape section of the report showcases the dynamic strategies employed by leading players to enhance profit margins and expand their market presence across different regions.

Unlock Insights with Our Free Sample Report – Request Yours Today- https://www.marknteladvisors.com/query/request-sample/asset-integrity-management-market.html

Market Dynamic

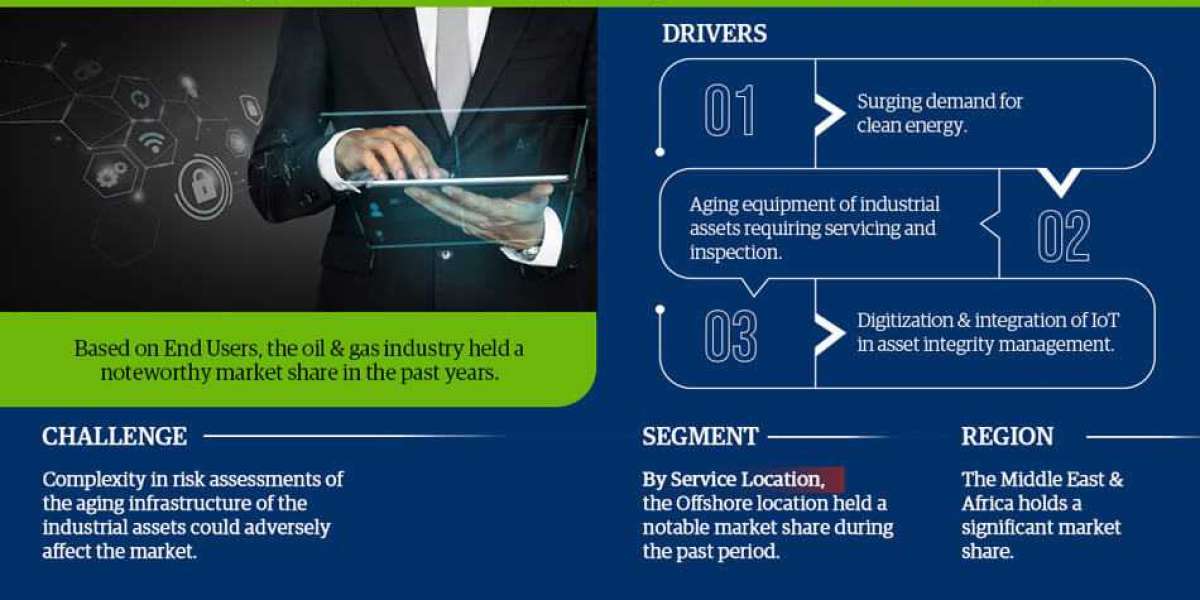

Key Driver: Surging Demand for Clean Energy to Drive the Asset Integrity Management Market

Growing demand for clean energy in a variety of industry verticals, such as steel manufacturing ammonia production, has resulted in a significant rise in clean energy production in recent years. This could be attributed to industries' growing preference for clean energy, such as nuclear hydrogen energy, to meet energy demand rather than petroleum-based products.

Additionally, the global commitment to zero coalition goals by 2050 is pushing governments across the world to pressure industries within their nations to adopt sustainable clean energy. Hence, countries across the globe are increasing clean energy production capacity through nuclear, solar, and hydrogen power plants. As a result, the construction addition of new clean energy power plants, such as nuclear hydrogen, boosted the demand for asset integrity management services in the historical years. For instance:

- In 2022, According to the Indian Government, the government planned to add nearly 15,000MW to the nation's current power-generating capacity by commissioning 20 new nuclear power plants by 2031.

Therefore, the growing number of nuclear hydrogen power plants also affects the demand for asset integrity management services due to the nature of inherent risks involved in such facilities in the coming years. Therefore, the surging count of nuclear hydrogen power production plants is anticipated to drive the market growth for asset integrity management services.

Possible Restraint: Complexity in Risk Assessments of Aging Infrastructure of the Industrial Assets to Adversely Affect the Market

Heavy industries, such as chemical industries in Europe and oil gas industries in the GCC region, were established a long time ago, thus the associated industrial assets are not equipped with a modern-day sensor for risk assessment, adding to the complexity of asset management. On top of this, upgradation projects the addition of new industrial assets overlapping the existing old aged ones make the whole management process cumbersome extremely complicated. The unavailability of the data also sums to the complexity as it broadens the range of unknown variables, which decreases the efficacy of the design.

In addition, the assets of matured rigs are timeworn, due to which accessing quantifying the conditions of the same adds to the existing intricacy in the asset integrity management services. Thus, the complexity formed by the combinations of old new assets in the old upcoming industries possess a challenge for asset integrity management companies.

Growth Opportunity: Upgradation Modernization of Industrial Assets to Augment the Asset Integrity Management Services

The industries such as iron, steel chemical, etc., are moving towards environmentally friendly structural changes in their respective industries. Numerous guidelines have been issued by the governments of countries, including the UK Germany, to meet sustainability goals. Thus, to meet these guidelines, modifications are required in the industry set up for which asset integrity management firms play a major role. There, the upgradation modification of the assets of the established industries would require a lot of assistance from the technical expertise offered by the asset integrity management firms. Hence, this creates an area of opportunity for asset integrity management corporations, which would support market growth in the coming years.

The competitive landscape of the Europe Probiotic Supplements Market depicts the dynamic scenario among industry players, highlighting their market positions, strategies, and initiatives. It encompasses an analysis of key competitors, their strengths, weaknesses, opportunities, and threats (SWOT analysis). The report also sheds light on the market share, product offerings, business expansion, collaborations, mergers and acquisitions, and other strategic activities undertaken by these players to gain a competitive edge. Additionally, it examines the competitive intensity, market barriers, and potential entry of new players, providing a comprehensive understanding of the market's competitive landscape.

-Aker Solutions ASA

-Applus+ Group

-Bureau Veritas S.A.

-DNV GL

-EMI Group

-Fluor

-Intertek Group PLC

-John Wood Group

-LifeTech Engineering Ltd.

-Metegrity, Inc.

-Oceaneering International

-ROSEN Swiss AG

-SGS S.A.

-TechnipFMC plc

-TÜV SÜD

-Others (Mistras Group Inc., Asset Integrity Engineering, etc)

Explore Further: Access the Complete Report for Comprehensive and Detailed Insights! https://www.marknteladvisors.com/research-library/asset-integrity-management-market.html

Segmentation Unveiled: Analyzing Asset Integrity Management Market's Expansion and Mapping Demand, and Distribution across Geographies

By Services

-Risk-Based Inspection

-Pipeline Integrity Management

-Non-Destructive Testing

-Corrosion Management

-Structural Integrity Management

-Reliability, Availability, And Maintainability Study

-Others (Fitness for Service, Material Property Verification, etc.)

By Location

-Onshore

-Offshore

By End User Industries

-Oil Gas

-Power

-Mining

-Chemical

-Others (Marine, Construction, Transportation, etc.)

Contact Our Consultant Today and Tap into Our Knowledge for Maximum Advantage! - https://www.marknteladvisors.com/query/talk-to-our-consultant/asset-integrity-management-market.html

On the geographical front, the Asset Integrity Management Market expands across:

By Region

-North America

-South America

-Europe

-The Middle East Africa

-Asia-Pacific

MarkNtel Advisors is a leading research, consulting, data analytics firm that provides an extensive range of strategic reports on diverse industry verticals. We deliver data to a substantial varied client base, including multinational corporations, financial institutions, governments, individuals, among others.

Our specialization in niche industries emerging geographies allows our clients to formulate their strategies in a much more informed way and entail parameters like Go-to-Market (GTM), product development, feasibility analysis, project scoping, market segmentation, competitive benchmarking, market sizing forecasting, trend analysis, among others, for 15 diverse industrial verticals. Using such information, our clients can identify attractive investment opportunities strategize their moves to yield higher ROI (Return of Interest) through an early mover advantage with top-management approaches.

We appreciate you reading our report. Please get in touch with us if you have any additional questions, and our team will provide you the report that best meets your needs.

Contact us today!

Email: [email protected]

Phone: +1 628 895 8081 +91 120 4268433,

Address: 5214F Diamond Heights Blvd #3092,

San Francisco, CA 94131

United States